Uninsured / Underinsured Motorist Accidents

What happens if I am hit by an uninsured or underinsured motorist?

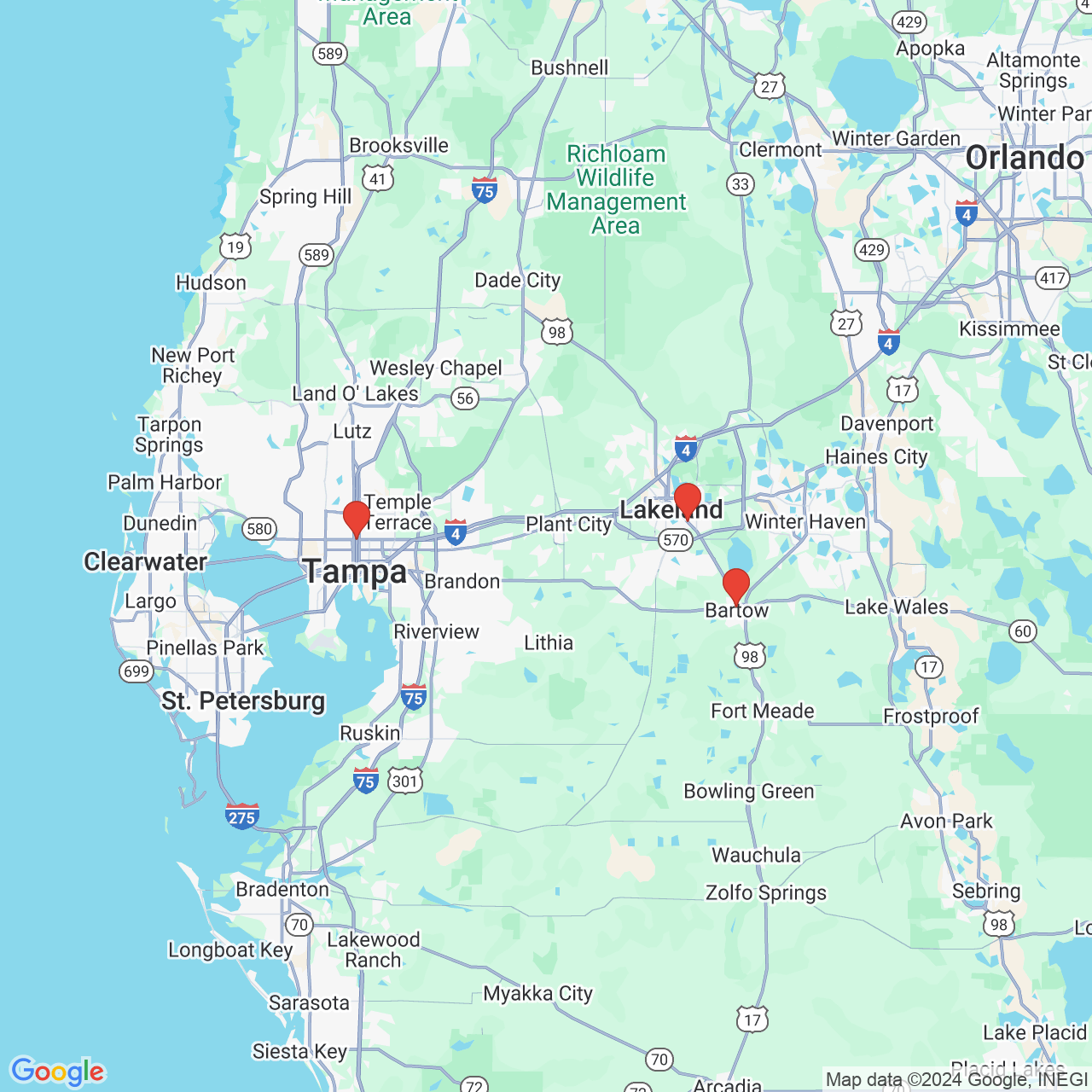

Uninsured or underinsured motorist coverage (UM) is insurance coverage that you purchase for yourself in the event of an automobile accident where the at-fault driver either has no insurance or not enough insurance. Many drivers in the state of Florida do not have any insurance at all. Others may purchase the absolute minimum coverage to stay “legal” per Florida laws - only to find out after an automobile accident that they do not have bodily injury liability coverage (BI). Although Florida law states that a driver may have his or her driver’s license suspended if they cannot cover damages exceeding $10,000.00 after an accident, we recommend that you purchase UM coverage of your own. Without your own UM coverage, you might be left without any way to obtain payment for the medical expenses, physical injuries, pain and suffering, lost wages, loss of earning capacity, and inconvenience that you have suffered. If you or someone you know has been injured by an uninsured or underinsured motorist in a car accident and needs a lawyer, contact an attorney from Moody Law, serving Central Florida and Polk County, including Lakeland, Bartow, Winter Haven, and Haines City, for more information regarding your potential claim.

Uninsured Motorist Accident Lawsuits

UM cases are more complex than a liability case against the at-fault driver. In a UM case, your uninsured motorist carrier will stand in the shoes of the at-fault driver at trial. In these accident cases, our Central Florida firm will file a lawsuit on your behalf against your own insurance company when they fail to pay you the benefits that you are due. Many times, your insurance company will assert that they have not denied your claim but, instead, do not value the claim in the same manner that we do. Your insurance company has a duty to act fairly and honestly while settling your claim; we may pursue your rights with a Civil Remedy Notice of Insurer Violation with the Florida Department of Financial Services. In certain cases, the Department of Financial Services may fine or punish the insurance company for denying your claim. After the filing of the Civil Remedy Notice of Insurer Violation, your insurance company has 60 days to pay your claim.

Uninsured Motorist Claims after a Car Accident: Contact an Attorney - Central Florida, Lakeland, Winter Haven

If you are having difficulty resolving insurance claims after being hit by an uninsured driver, contact a car accident lawyer at Moody Law. We serve Central Florida, including Lakeland, Winter Haven, Bartow, Haines City, Plant City, and Tampa Bay.